Underneath the surface area, however, there are a lot of moving parts. Even little options in how you get ready for homeownership, or what kind of home mortgage you get, can have huge repercussions for your bank account. It's everything about dealing with a loan provider you feel comfy with and you trust to understand your scenario, states Kevin Parker, vice president of field mortgage at Navy Federal Credit Union.

In just the past few months, the method you set about purchasing a home has actually altered, as the market has actually gotten used to an increasingly remote process. In the middle of a pandemic and recession, it's much more essential to understand what you'll need for a smooth home loan process.Get Your Finances in OrderGet Preapproved for a Home loanStore for the Right Home Mortgage and Loan ProviderNavigate the Underwriting and Closing ProcessPurchasing a home, particularly if it's your first time, can be a complicated and demanding process.

Dealing with a skilled property representative and loan provider or mortgage broker can help you browse the process. Preparing your financial resources is significantly essential offered how careful lenders have ended up being. Sean Moss, the timeshare vacation promotions director of operations for Deposit Resource, an aggregator of property buyer help programs, advises you start the procedure by talking with a loan officer.

You ought to focus on 2 things: Building your credit and saving your money. Having more money on hand and a more powerful credit history will assist you be able to pay for a larger range of houses, making the time it takes to shore up both well worth it. Your approval odds and home mortgage choices will be much better the greater your credit rating.

How Do Escrow Accounts Work For Mortgages Fundamentals Explained

The lower your credit score, the greater your home loan rates of interest (and thus funding expenses). how does chapter 13 work with mortgages. So reinforcing your credit by paying your costs on time and paying off financial obligation can make a home mortgage more budget-friendly. 2 of the best things you can do to get the best home loan rates: putting in the time to develop up your credit rating and conserving for a deposit of at least 20%.

You'll require a big chunk of money to pay upfront closing expenses and a deposit. Closing expenses include all fees associated with processing the home loan and typical 3% -6% of the purchase price. A healthy deposit will be 20% of the home's worth, though it is possible to purchase a house with a smaller sized deposit, particularly for specific types of loans.

But do not let that number prevent you from making own a home a truth. There are ways to bring it down. There are regional and regional programs that use closing cost and deposit help for competent purchasers, usually novice homeowners or buyers with low-to-moderate income. This help normally is in the kind of a grant, low or no-interest loan, or a forgivable loan.

This assists the borrower keep cash in savings so they're much better http://donovancyyx861.tearosediner.net/things-about-when-did-30-year-mortgages-start prepared for emergencies and the extra expenditures of homeownership. Getting preapproved for a home mortgage offers you a great idea of how much you can borrow and shows sellers you are a certified purchaser. To get a preapproval, a loan provider will check your credit rating and evidence of your income, assets, and work.

More About Why Are Most Personal Loans Much Smaller Than Mortgages And Home Equity Loans?

The majority of preapproval letters are legitimate for 60-90 days, and when it comes time to make an application for a home loan all of your info will need to be reverified. Likewise, do not confuse preapproval with prequalification. A prequalification is a quick estimate of what you can obtain based on the numbers you share and doesn't require any paperwork.

When looking for a mortgage it's an excellent idea to look around to compare rates and fees for 2-3 loan providers. When you send a mortgage application, the lending institution is required to give you what is known as a loan price quote within three service days. Every loan price quote includes the exact same info, so it's easy to compare not only rates of interest, but also the upfront charges you'll require to pay.

It's also important to comprehend the various mortgage terms. The term is the amount of time the loan is repaid over typical home loan terms are 10, 15, and thirty years. This has a big influence on your regular monthly payment and how much interest you pay over the life of the loan.

A shorter-term loan will save you money on interest. This is since much shorter loans generally have lower rate of interest, and you're paying the loan off in a shorter quantity of time. To understand how various terms impact your bottom line, utilize our home mortgage calculator to see how the month-to-month payment and the total interest you'll pay changes.

The Buzz on How Many Mortgages Should I Apply For

There are fixed-rate loans, which have the exact same interest for the duration of the mortgage, and adjustable rate home loans, which have a rate of interest that alters with market conditions after a set number of years. There are also what are referred to as government-backed loans and standard loans. A government-insured home mortgage is less dangerous for the loan provider, so it might be easier to receive, however features extra limitations.

Department of Farming (USDA) are only provided for properties found in a qualifying rural location. Likewise, the personal home loan insurance requirement is usually dropped from traditional loans when the loan-to-value ratio (LTV) falls to 80%. But for USDA and Federal Housing Administration (FHA) loans, you'll pay a variation of home loan insurance coverage for the life of the loan.

Your financial health will be carefully scrutinized throughout the underwriting process and prior to the home loan is released or your application is declined. You'll need to offer recent paperwork to validate your work, income, assets, and debts. You may also be needed to send letters to describe things like employment gaps or to record gifts you get to assist with the deposit or closing costs.

Avoid any big purchases, closing or opening brand-new accounts, and making unusually big withdrawals or deposits. As part of closing, the loan provider will need an appraisal to be completed on the home to confirm its value. You'll also need to have a title search done on the home and protected lending institution's title insurance and house owner's insurance.

What Is Wrong With Reverse Mortgages Can Be Fun For Everyone

Lenders have actually become more strict with whom they are ready to loan money in response to the pandemic and ensuing financial recession. Minimum credit history requirements have increased, and lending institutions are holding borrowers to higher standards. For instance, lenders are now confirming work just before the loan is completed, Parker states.

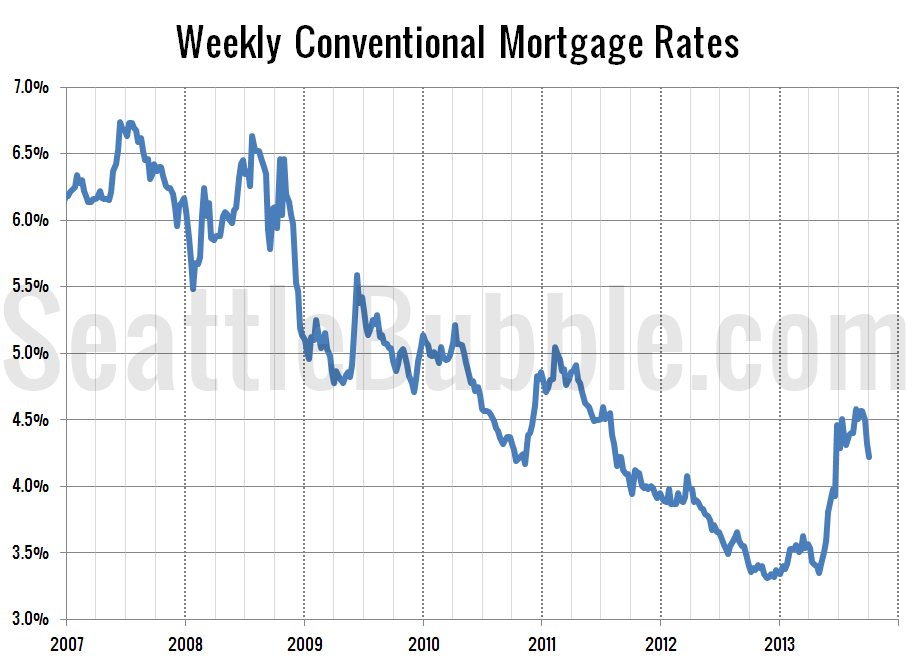

Many states have fasted lane approval for making use of digital or mobile notaries, and virtual home trips, " drive-by" appraisals, and remote closings are ending up being more cancel my timeshare typical - how do buy to rent mortgages work. While lots of lenders have actually refined the logistics of approving home mortgage from another location, you might still experience delays while doing so. All-time low mortgage rates have actually triggered a boom in refinancing as existing property owners seek to save.

Spring is normally a busy time for the genuine estate market, but with the shutdown, lots of purchasers had to put their house searching on pause. As these purchasers return to the market, loan originators are becoming even busier.